Taxation

Aviation continues to enjoy a favourable taxation position in the UK

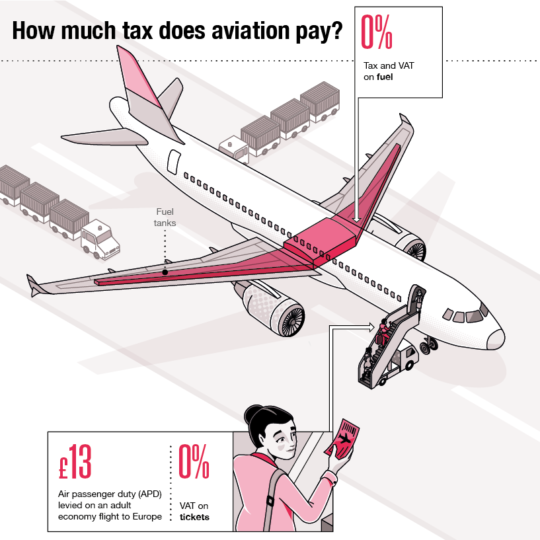

AEF has long been lobbying and raising awareness about the lack of taxation on kerosene, which makes flying artificially cheap compared with other modes of transport, particularly driving. If aviation paid tax and VAT on its fuel at the same rate as motorists pay on theirs, the potential revenue would amount to over £12 billion a year.

There is no global treaty preventing the introduction of a kerosene tax

In contrast to popular belief, there is no global treaty preventing the introduction of a kerosene tax between individual states. Instead individual countries would need to renegotiate their Air Service Agreements bilaterally – we calculated that up to 82% of fuel sold in the UK could potentially be covered by a kerosene tax if agreements were amended with the EU, and the ten most popular aviation destinations.

AEF continues to lobby the Treasury to introduce a kerosene tax, and to explore opportunities to develop Air Passenger Duty (APD). The decision in 2024 to increase APD by 50% on certain private jets was welcome – APD has been allowed to fall below inflation, and luxury private jet flights have almost completely escaped taxation. Three-quarters of private jet passengers pay the same APD as premium economy passengers, or pay no APD at all. With the huge rise in private jet flights in the UK since Covid (one in ten flights in the UK is currently a private jet flight) this was a glaring loophole.

Emissions Trading Schemes (ETS)

In 2012, the EU proposed to include emissions from all flights operating into and out of EU airports in its Emissions Trading Scheme in order to provide a decarbonisation incentive in a “hard to abate” sector lacking a carbon price. International pressure, including at ICAO, led to that change being postponed, leaving only intra-EU flights in the ETS, while ICAO attempted to establish a global carbon market scheme for international aviation (Corsia, see below).

In 2021, the UK set up its own ETS after leaving the European Union, but this also only covers domestic flights and those between the UK and European Economic Area. Airlines also enjoy free allowances, designed to protect against the risk of carbon leakage. The effect of all these exemptions has been that a carbon price has only been applied to around 12% of the UK’s recent aviation emissions. The current ETS price (average £37 per tonne in 2024) is well below the value used by the Climate Change Committee to model its aviation decarbonisation pathway in CB7 (the Government’s high carbon values the traded sectors were expected to pay between £79-100tCO2 in 2025)

CORSIA

Since 2020, airlines flying on international routes between participating countries are required to purchase offset credits (from a list of eligible projects) to cover their emissions above a baseline. This International Civil Aviation Organisation (ICAO) scheme is known as the Carbon Offsetting and Reduction Scheme for International Aviation (Corsia). Following its introduction, the global reduction in international air traffic caused by the Covid-19 pandemic meant that traffic did not rebound to levels above the baseline (the scheme currently covers the growth in international airline emissions above a baseline of 85% of 2019 levels) until 2024/25. Any growth must be compensated by the purchase of Corsia approved offset credits or alternative fuels.

CORSIA comprises a robust framework for assessing CORSIA eligible fuels and monitoring, reporting and verification guidelines, having survived a tumultuous few years in international diplomacy. However, AEF believes the scheme needs to be more ambitious, ensuring the available credits are of the highest quality, and not just dubious forestry offset credits which will likely continue to be at the cheaper end of the market. It should transition away from avoided emission offsets, in favour of greenhouse gas removal projects, as well as reducing the baseline in line with a pathway to achieve net zero by 2050.

Frequent flyers

With our partners at the New Economics Foundation and Possible, we have contributed to the development of proposals for a frequent flyer levy, which would be aimed at tackling the problem of individuals flying multiple times a year. We believe it is fairer that those who fly multiple times a year should pay more for their carbon emissions through the development of progressive taxation measures.