21st May, 2025

The Government’s sustainable aviation fuel (SAF) mandate came into effect at the start of this year, enforcing a steadily increasing amount of SAF in the overall UK aviation fuel mix. The mandate requires 2% of fuel supply in 2025 to be SAF, rising to 10% in 2030 and 22% in 2040. The mandate is one of the few major policies currently in place designed to decarbonise aviation.

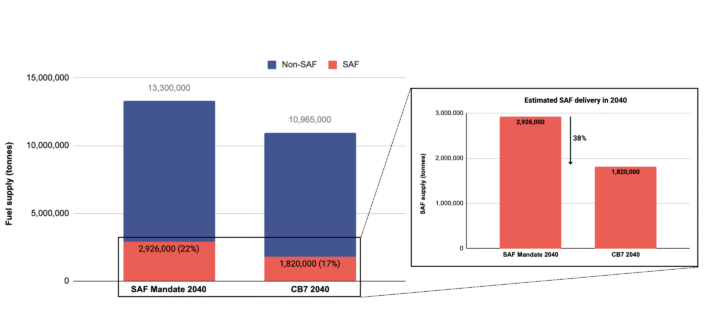

In February this year, the Government’s climate advisors, the Climate Change Committee (CCC), published their Seventh Carbon Budget (CB7). This provides advice on emissions reductions over the five-year period 2038-2042 in the UK. Within this, SAF is projected to meet 17% of UK aviation fuel demand in 2040, less than the mandated 22%.

However, these 17% and 22% figures are based on different total fuel consumption levels (due to diverging expectations of passenger demand), meaning that the gap is larger than it first looks. The mandate modelling estimates 2.9 million tonnes of SAF in 2040, whereas CB7 projects 1.8 million tonnes, a difference of 1.1 million tonnes of SAF. In other words, the Climate Change Committee is projecting 38% less SAF supply in 2040 than the amount expected to be required by the SAF mandate. This gap in projections is significant, especially given that there are already growing concerns over sourcing genuinely sustainable SAF, despite SAF supply only being expected to make up around 230,000 tonnes this year.

There is a similar mismatch in the figures for 2030, with the mandate projecting 10% of supply to be 1,200,000 tonnes and CB7 estimating just 666,000 tonnes of SAF usage (44% less). Fuel suppliers will face significant penalties if the mandated amount is missed in any given year.

Demand expectations (and therefore total fuel consumption) within the CB7 pathway are constrained, as according to the CCC, ‘aviation demand can only grow if aviation sector technology roll-out progresses and begins to abate and offset aviation emissions’. Their SAF trajectory is ‘lower than the Government’s SAF trajectory due to the expected supply constraints in the late 2020s and 2030s, long-term uncertainties regarding the costs and supply of SAF, particularly synthetic fuels, and projected cost effectiveness of engineered removals compared to SAF.’ UK SAF feedstocks will be in demand from other sectors and will face competition to supply SAF targets outside of the UK (e.g. mandates in the EU and China). SAF supply in CB7 may also be limited as only synthetic SAF produced in the UK is included in the analysis (due to uncertainty over how to report emissions savings from imported synthetic fuels).